How to Calculate IRR on a Financial Calculator

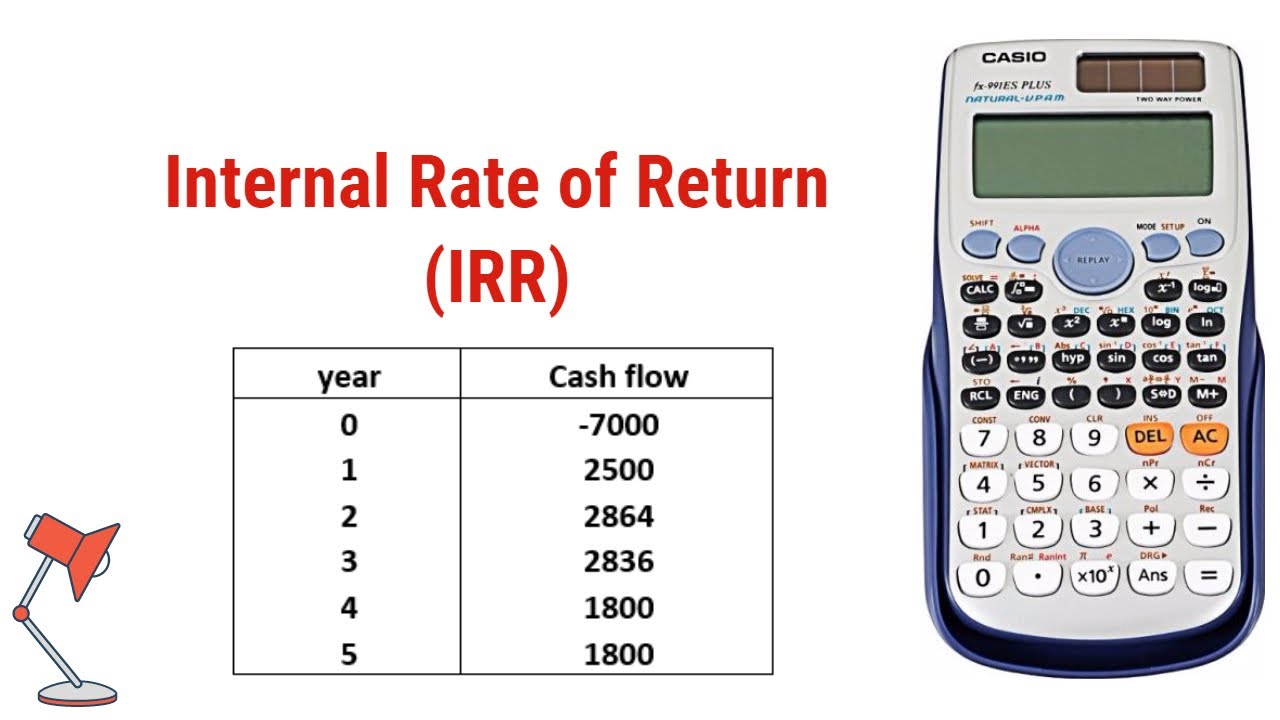

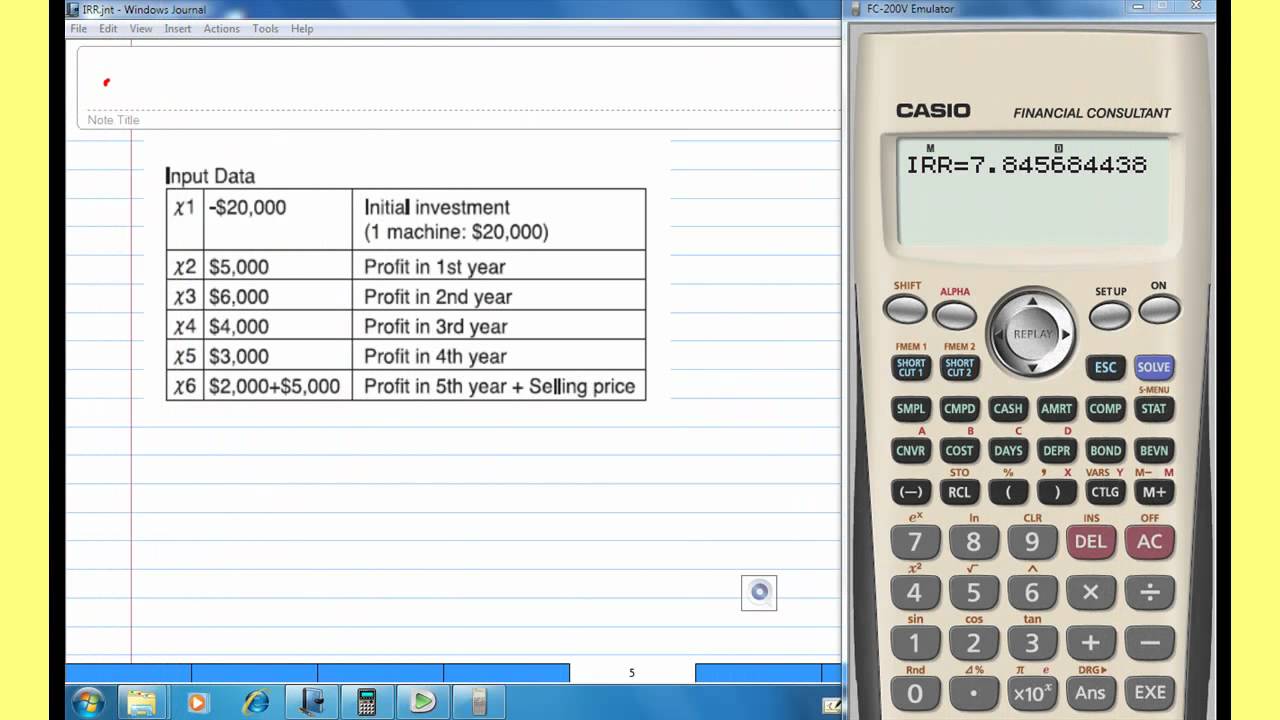

The internal rate of return (IRR) is a measure of the profitability of an investment. It is the annualized rate of return that makes the net present value of all cash flows equal to zero. To calculate the IRR on a financial calculator, you will need to enter the following information:

- The initial investment

- The cash flows

- The number of years

Once you have entered this information, you can use the IRR function on your calculator to find the IRR. The IRR is typically expressed as a percentage.

How to Calculate IRR on a Financial Calculator

The internal rate of return (IRR) is a crucial metric for evaluating the profitability of an investment. It represents the annualized rate of return that equates the net present value of all cash flows to zero. Calculating the IRR on a financial calculator involves several key aspects:

- Input Parameters: Initial investment, cash flows, and number of years must be accurately entered into the calculator.

- IRR Function: The calculator's IRR function is used to compute the IRR based on the input parameters.

- Interpretation: The IRR is expressed as a percentage and indicates the profitability of the investment.

- Decision-Making: If the IRR exceeds the required rate of return, the investment is considered profitable.

- Limitations: IRR may not be suitable for all types of investments or when cash flows are irregular.

Understanding these aspects is essential for effectively utilizing financial calculators to calculate IRR. By considering the initial investment, cash flows, and time horizon, investors can make informed decisions about the viability of potential investments.

Input Parameters

Precise input parameters are fundamental for accurate IRR calculations. The initial investment represents the starting capital, while cash flows encompass all future inflows and outflows associated with the investment. The number of years determines the time horizon over which these cash flows occur. Any errors or omissions in these inputs can significantly impact the calculated IRR.

For instance, understating the initial investment would result in an overstated IRR, as the calculator would allocate a larger portion of the cash flows to return on investment rather than capital recovery. Similarly, omitting a negative cash flow could lead to an inflated IRR that does not accurately reflect the project's profitability.

Therefore, careful attention to input parameters is crucial for reliable IRR calculations. Accurate data ensures that the IRR reflects the true profitability of the investment, enabling informed decision-making and effective financial planning.

IRR Function

The IRR function is a crucial component of IRR calculation on a financial calculator. It serves as the mathematical engine that processes the input parameters (initial investment, cash flows, and number of years) to determine the IRR. This function employs iterative numerical methods to find the discount rate that equates the net present value of all cash flows to zero.

Understanding the IRR function is essential for comprehending how financial calculators compute IRR. Without this function, it would not be possible to automate the complex calculations required to determine the IRR. The IRR function enables calculators to quickly and accurately calculate this important financial metric.

In practical terms, the IRR function empowers investors and financial analysts to make informed decisions about potential investments. By providing a reliable measure of profitability, the IRR function helps individuals assess the attractiveness of investment opportunities and compare different projects on a consistent basis.

Interpretation

The interpretation of the IRR is a critical aspect of understanding how to calculate IRR on a financial calculator. The IRR, expressed as a percentage, serves as a concise indicator of an investment's profitability, providing a valuable metric for decision-making.

A positive IRR signifies that the investment is expected to generate returns that exceed the initial investment and any financing costs, indicating a potentially profitable venture. A negative IRR, on the other hand, suggests that the investment may not yield sufficient returns to cover its costs, signaling a potentially unprofitable investment.

To illustrate, consider an investment with an IRR of 8%. This means that the investment is expected to generate an annualized return of 8% over its lifetime. By comparing this IRR to other potential investments or to a benchmark rate, investors can gauge the relative attractiveness of the investment and make informed choices.

Understanding the interpretation of IRR empowers investors to effectively analyze and compare investment opportunities, enabling them to make sound financial decisions and maximize their returns.

Decision-Making

Understanding this connection is critical for effective investment decision-making. The required rate of return represents the minimum acceptable return an investor expects from an investment, considering factors such as inflation, risk tolerance, and alternative investment opportunities. By comparing the IRR to the required rate of return, investors can determine the potential profitability of an investment.

If the IRR exceeds the required rate of return, it indicates that the investment is expected to generate returns that surpass the minimum acceptable threshold. This suggests that the investment has the potential to yield positive returns and is, therefore, considered profitable. Conversely, if the IRR falls below the required rate of return, it implies that the investment may not generate sufficient returns to meet the investor's expectations and is thus deemed unprofitable.

For instance, consider an investor with a required rate of return of 7%. If an investment opportunity presents an IRR of 9%, it indicates that the investment is expected to generate returns that exceed the investor's minimum acceptable threshold. This positive spread between the IRR and the required rate of return suggests that the investment is potentially profitable and may be worth considering.

Calculating the IRR using a financial calculator is a crucial step in making informed investment decisions. It provides a quantitative measure of an investment's profitability, enabling investors to compare different investment opportunities, assess risk-return profiles, and make sound financial choices.

Limitations

The limitations of IRR should be considered when using a financial calculator to assess the profitability of an investment. IRR may not be suitable for all types of investments or when cash flows are irregular, as it assumes:

- Constant Cash Flows: IRR assumes that cash flows occur at regular intervals and are constant in value. However, in reality, cash flows can be irregular or vary in amount, which can impact the accuracy of IRR calculations.

- Single Rate of Return: IRR produces a single rate of return for an investment, but in some cases, there may be multiple IRRs or no IRR at all, particularly when cash flows are complex or involve non-conventional patterns.

- Reinvestment Rate: IRR assumes that all cash flows are reinvested at the IRR, which may not be a realistic assumption in practice. The actual reinvestment rate can affect the overall profitability of the investment.

- Sensitivity to Changes: IRR can be sensitive to changes in cash flows, especially near the breakeven point. Small variations in cash flows can lead to significant changes in the calculated IRR.

Understanding these limitations is crucial when interpreting the results of IRR calculations. Investors should consider the specific characteristics of their investments and the assumptions underlying IRR to ensure that it is an appropriate metric for evaluating profitability.

FAQs on Calculating IRR using a Financial Calculator

This section addresses frequently asked questions (FAQs) regarding the calculation of Internal Rate of Return (IRR) using a financial calculator.

Question 1: Why is it important to calculate IRR?

Answer: IRR is a crucial metric for evaluating the profitability of an investment. It represents the annualized rate of return that equates the net present value of all cash flows to zero. By calculating IRR, investors can compare different investment opportunities, assess their potential profitability, and make informed decisions.

Question 2: How do I enter cash flows into a financial calculator for IRR calculation?

Answer: Cash flows should be entered as positive values for inflows and negative values for outflows. Enter the initial investment as the first cash flow, followed by subsequent cash flows in chronological order.

Question 3: What is the difference between IRR and NPV?

Answer: IRR is the discount rate that makes the NPV of a project equal to zero. NPV, on the other hand, is the sum of the present values of all future cash flows discounted at a specific rate. While IRR provides a single rate of return, NPV considers the time value of money and can handle irregular cash flows.

Question 4: Can IRR be negative?

Answer: Yes, IRR can be negative. A negative IRR indicates that the investment is expected to generate a loss over its lifetime.

Question 5: What are the limitations of IRR?

Answer: IRR assumes constant cash flows, a single rate of return, and reinvestment of cash flows at the IRR. These assumptions may not always be realistic, and IRR may not be suitable for all types of investments.

Question 6: How can I use a financial calculator to compare multiple investment options?

Answer: Enter the cash flows for each investment option into the calculator and calculate the IRR for each. The investment with the highest IRR is generally considered the most profitable.

Summary: Calculating IRR using a financial calculator is a valuable tool for evaluating investment opportunities. Understanding the concept, limitations, and interpretation of IRR is essential for making informed financial decisions.

Transition to the next article section: The following section explores advanced techniques for IRR calculation and its applications in financial analysis.

Conclusion

In conclusion, understanding how to calculate IRR on a financial calculator is essential for evaluating the profitability of investments. By considering the initial investment, cash flows, and time horizon, investors can determine the IRR, which represents the annualized rate of return that equates the net present value of all cash flows to zero. This metric provides a concise indicator of an investment's potential profitability and enables comparisons between different investment opportunities.

While IRR offers a valuable tool for investment analysis, it is important to consider its limitations and underlying assumptions. Factors such as irregular cash flows, reinvestment rates, and multiple rates of return can affect the accuracy and applicability of IRR. Therefore, investors should exercise caution when interpreting IRR and consider other financial metrics and qualitative factors to make informed investment decisions.

Understanding The Essential Elements: The Key Characteristics Of Constructivism

Why You Shouldn't Reheat Goose Fat Roast Potatoes: The Ultimate Guide

Ikea: Convenient Home Delivery Services At Your Fingertips

How To Calculate Irr Calculator Haiper

How To Calculate Irr On Financial Calculator Haiper

Internal Rate of Return, IRR with CASIO Financial calculator YouTube